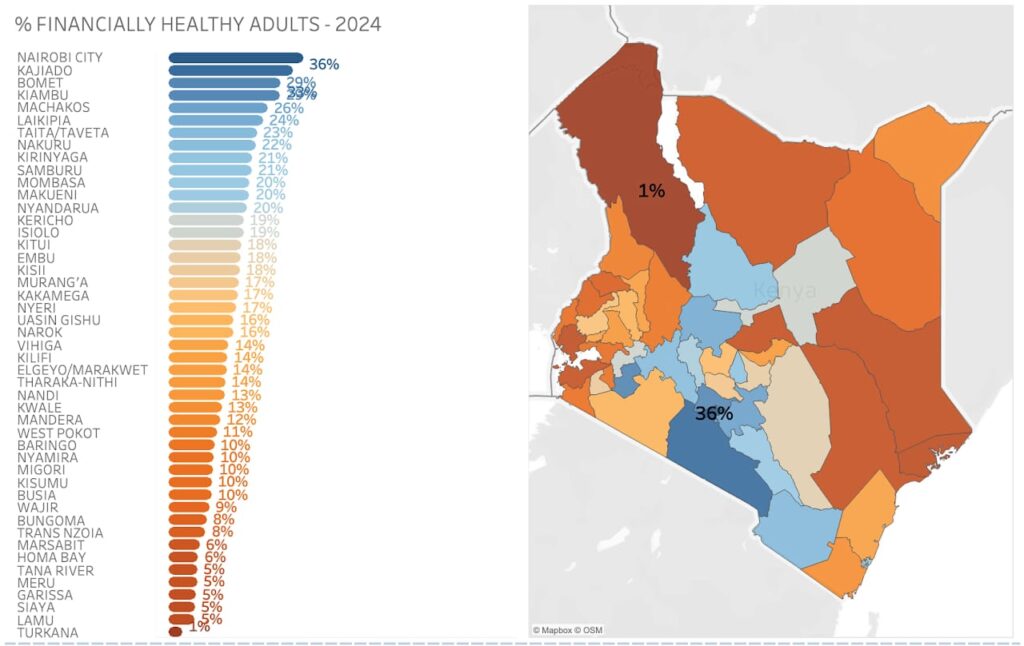

The SACCO sector in Kenya is undergoing a radical transformation in service delivery, driven by the rapid adoption of digital technology. A recent FinAccess Household Survey 2024 reveals that 98.9% of SACCO members nationwide prefer digital channels over traditional visits to SACCO headquarters or branches, underscoring a significant shift in member behavior.

The FinAccess Household Survey Topline Findings Report highlights the widespread adoption of modern service delivery channels such as agency banking, internet platforms, and mobile technologies. These digital innovations have reshaped member interactions, making access to financial services more convenient and efficient.

However, the report reveals disparities in digital transformation among SACCO members, with clear differences based on geographical and demographic factors. Rural users display a higher preference for traditional channels, with 75.1% favouring them, compared to 60.7% of urban users. This contrast underscores the varying levels of access and technology adoption between rural and urban areas.

Generational and Gender Gaps

The generational divide in technology adoption is striking. Among members aged 55 years and above, 80.2% prefer traditional SACCO services, while only 41.8% opt for mobile channels. This generational gap reflects the challenges older members face in embracing new technologies, which often require familiarity with digital tools and platforms.

In rural areas, traditional SACCO usage remains dominant at 66.7%, compared to 52.0% in urban settings. Rural members express strong confidence in branch-based services, which they perceive as more reliable and personal.

Gender differences also play a significant role in technology adoption within SACCOs. Female members show a strong preference for mobile payment options, such as Paybill services, with usage rates at 28.5% in urban areas compared to 14.3% in rural regions. The simplicity and accessibility of these services make them particularly appealing to women.

In contrast, men dominate in the use of mobile apps and USSD platforms, accounting for 51.6% of users compared to 47.8% among women. The perceived complexity of these technologies is cited as a potential barrier for female users.

Urban vs. Rural Digital Adoption

The survey highlights the contrasting levels of digital adoption between urban and rural SACCO members. In urban areas, 56.8% of members use mobile apps and USSD platforms, slightly higher than the 44.1% recorded in rural regions. This disparity points to the need for targeted strategies to bridge the digital divide.

Urban members also exhibit a higher adoption rate of digital payment options. The use of Paybill services, for instance, is significantly more common in urban settings, reflecting the greater accessibility and familiarity with digital tools in cities.

Barriers to Technology Adoption

Despite the rapid adoption of digital channels, several barriers remain. Limited access to technology, especially in rural areas, continues to hinder the widespread adoption of digital SACCO services. Older members and women face additional challenges due to a lack of tailored training and user-friendly interfaces.

The report emphasizes the need for SACCOs to address these barriers by providing education and support to members. Simplifying digital platforms and offering targeted training programs could enhance inclusivity and accelerate the transition to digital channels.

Growth in SACCO Membership

The survey also highlights the growth in SACCO membership over the past four years. The overall SACCO usage rate in Kenya has risen from 9.6% in 2021 to 11.7% in 2024. This increase is attributed to the growing number of households joining SACCOs, drawn by the relatively lower loan rates offered during a period of high interest rates.

The Road Ahead

The evolving landscape of SACCO service delivery reflects a broader shift in Kenya’s financial sector. As SACCOs continue to embrace digital technology, they must prioritize inclusivity and accessibility to ensure that all members benefit from these innovations.

Tailored solutions, such as simplified user interfaces and training programs, are essential to overcoming the barriers faced by rural members, older generations, and women. By addressing these challenges, SACCOs can create a more equitable and efficient system that caters to the diverse needs of their members.

The findings from the FinAccess Household Survey 2024 paint a hopeful picture of the future of SACCOs in Kenya. With strategic investments in technology and member education, the sector is poised to become a model of financial inclusion and innovation in the region.

Kenya’s SACCO sector stands at a crossroads, with technology reshaping how members interact with their financial cooperatives. While significant progress has been made, the journey toward full digital transformation requires addressing disparities in access and adoption. By bridging these gaps, SACCOs can unlock their full potential and continue to play a pivotal role in the financial empowerment of Kenyan households.