Kenya’s agriculture sector has emerged as one of the biggest winners in the 2025/2026

national budget, receiving a substantial allocation of KShs 47.6 billion. The funding, part of

the country’s KShs 4.2 trillion total budget, reflects the government’s firm commitment to

transforming agriculture into a robust, resilient, and market-driven sector capable of

boosting food security and creating employment opportunities.

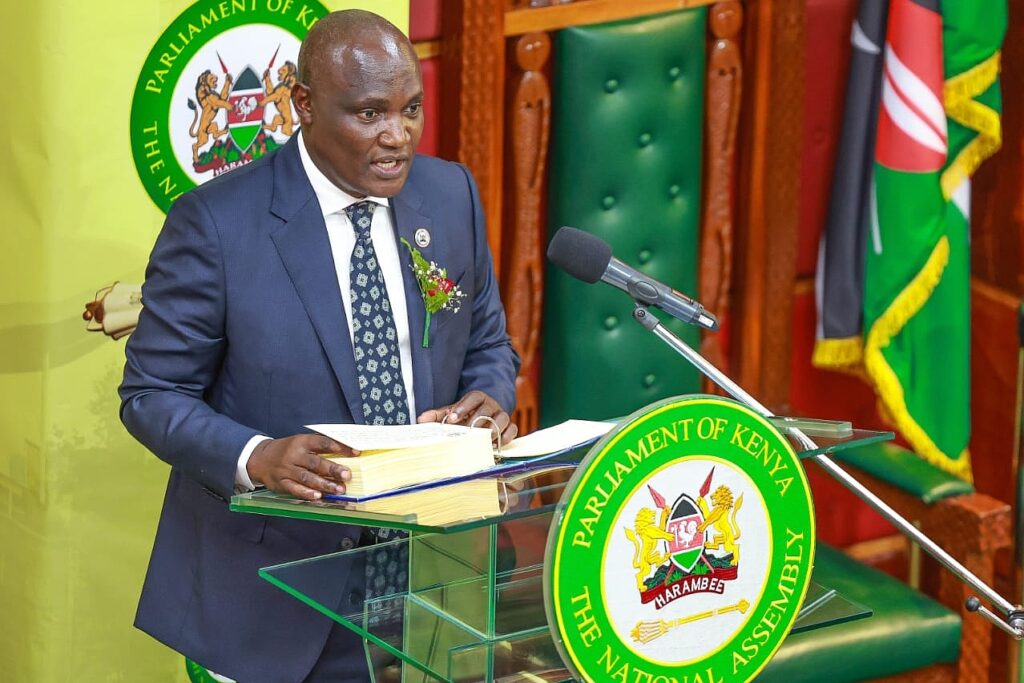

The budget, unveiled by National Treasury and Economic Planning Cabinet Secretary John

Mbadi, outlines targeted funding for key programs and projects that are expected to

address existing challenges and enhance agricultural productivity across value chains.

Among the flagship projects receiving significant funding is the National Agricultural Value

Chain Development Project (NAVCD), which has been allocated KShs 10.2 billion. This

initiative aims to help farmers increase income by adding value to their produce before

reaching the market — a major shift from traditional raw output selling.

The Fertilizer Subsidy Programme, allocated KShs 8.0 billion, will ensure continued

affordability of agricultural inputs, directly supporting farmers at the grassroots level.

Another KShs 800 million has been allocated to the Small-Scale Irrigation and Value

Addition Project, which seeks to enhance resilience and processing capacity, especially in

arid and semi-arid areas.

Other projects include:

Food Security and Crop Diversification Project – KShs 1.2 billion

Food Systems Resilience Project – KShs 5.8 billion (focused on climate adaptation

and risk management)

Livestock Sector Investments

A total of KShs 5 billion has been channeled into various livestock-focused projects. These

include:

De-Risking, Inclusion, and Value Enhancement of Pastoral Economies – KShs 2.3

billion

Kenya Livestock Commercialization Programme (KeLCoP) – KShs 1.6 billion

Livestock Value Chain Support Project – KShs 280 million

Excess Milk Mop-Up Program – KShs 400 million (to cushion dairy farmers during

oversupply)

Modernization of Milk Factories in Runyenjes and Narok – KShs 150 million

Development of the Leather Industrial Park in Kenanie – KShs 340 million (to boost

value addition in the leather sector)

Blue Economy & Fisheries

With an eye on marine resources, the government has allocated KShs 8.2 billion to the blue

economy and fisheries sub-sector. Key projects include:

Aquaculture Business Development Project – KShs 2.3 billion

Kenya Marine Fisheries & Socio-Economic Development Project – KShs 2.4 billion

Kabonyo Fisheries & Aquaculture Training Centre – KShs 500 million

Climate Resilience & Drought Management

To counter climate-induced shocks, the budget includes:

Towards Ending Drought Emergencies (TEDE) – KShs 318 million

Resilience for Food and Nutrition Security in the Horn of Africa – KShs 1.3 billion

Kenya Financing Locally Led Climate Action Project – KShs 11.5 billion (some of

which will support agricultural resilience)

Land Reforms to Enable Agriculture

Land security remains central to sustainable agricultural investment. The budget sets aside:

Settlement of the Landless – KShs 3.8 billion

Title Deed Processing & Registration – KShs 1.1 billion

Digitization of Land Registries – KShs 712 million

Geo-Referencing of Land Parcels – KShs 200 million

Construction of New Land Registries – KShs 220 million

Boosting Cash Crops & Value Addition

Cash crop reforms also feature prominently:

Coffee Cherry Revolving Fund – KShs 2.0 billion

Coffee Debt Waivers – KShs 2.0 billion

Sugar Sector Reforms – KShs 1.5 billion

Cotton Ginneries Modernization – KShs 120 million

Horticultural Compliance Enhancement – KShs 245 million

National Edible Oil Crops Promotion Project – KShs 300 million

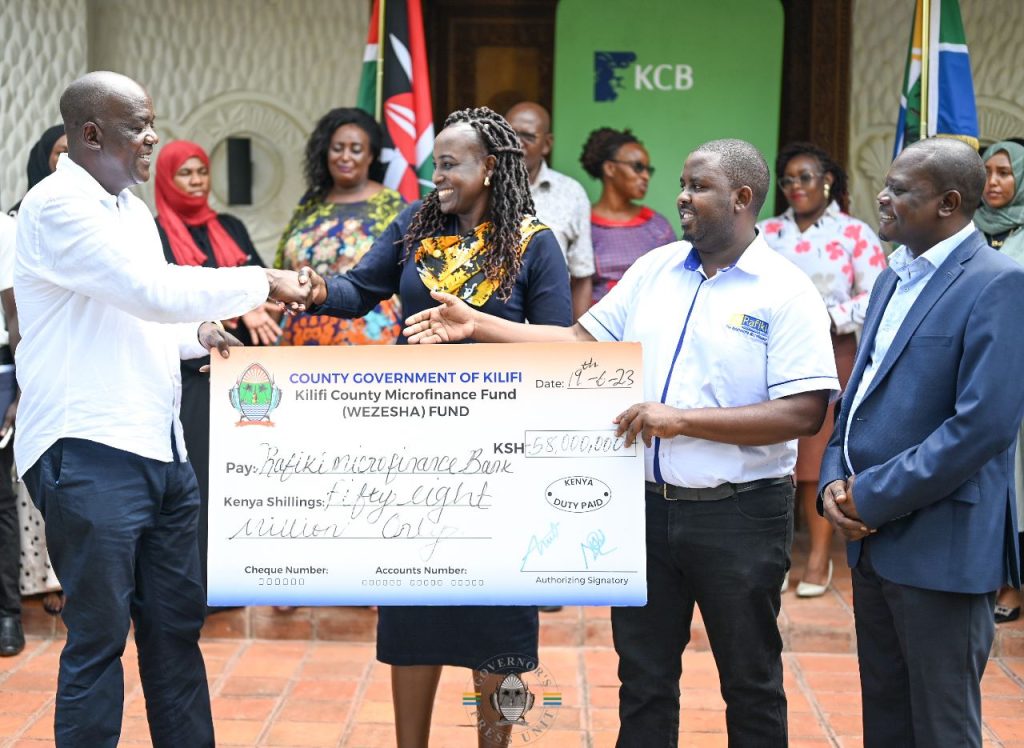

Support for Agri-MSMEs

Recognizing the role of micro and small enterprises in agri-business:

Hustler Fund (Financial Inclusion Fund) – Additional KShs 300 million

Rural Kenya Financial Inclusion Facility – KShs 1.3 billion

Tax Measures Supporting Agriculture

To complement budget allocations, the government has introduced tax relief measures,

including:

Continued duty remission on wheat imports and tea packaging materials

Duty-free imports of animal feed production inputs under EAC duty remission

Preferential import duty (35%) for leather products and chemical duty waivers for

leather processing

This robust allocation signals a new chapter for Kenyan agriculture. By addressing the entire

ecosystem—from production and value addition to market access and land security—the

government’s 2025/2026 budget lays the groundwork for a truly transformed and resilient

agricultural sector.