Kenya’s cooperative movement is undergoing a major rethink as the government rolls out reforms aimed at strengthening SACCO governance, financial stability, and long-term sustainability — with mergers emerging as a key strategy rather than a threat. At the heart of the proposed changes is a reassurance to small and low-income SACCOs that consolidation with larger societies is not intended to wipe them out, but to secure their future in an increasingly competitive and technology-driven financial environment. Cooperatives Principal Secretary Patrick Kilemi says the reforms are designed to stabilise the sector while improving internal controls and service delivery. A major focus is on governance, particularly the integrity and competence of top management.

Under the new framework, SACCO chief executive officers and senior managers will be subjected to a “fit and proper” test to assess their suitability to handle members’ funds. Those who fail the clearance will be barred from serving in any SACCO leadership position, closing the door on individuals whose past actions may have exposed members to financial risk. “Our intention is simple — to make savings in a SACCO as safe as savings in a bank,” Kilemi noted, adding that stronger controls will restore confidence and protect cooperative members.

Mergers Driven by Market Reality, Not Force.

While public debate has framed mergers as compulsory, cooperative leaders insist that consolidation will be shaped largely by market forces. Kenya National Police SACCO Chairperson David Mategwa argues that smaller SACCOs will not be forced to merge, but may find it increasingly difficult to operate independently. As member expectations shift toward convenience, speed, and digital access, SACCOs lacking the financial muscle to invest in technology risk losing relevance. According to Mategwa, technology adoption requires scale — something many small SACCOs simply do not have. “Members no longer want paperwork. They want digital services, and digital systems are expensive. Without numbers, it becomes impossible to compete,” he said. Mergers, he added, offer a pathway for SACCOs to pool resources, adopt shared systems, and strengthen decision-making, much like established commercial banks do to protect depositors and grow trust.

Addressing the Challenge of Inactive SACCOs.

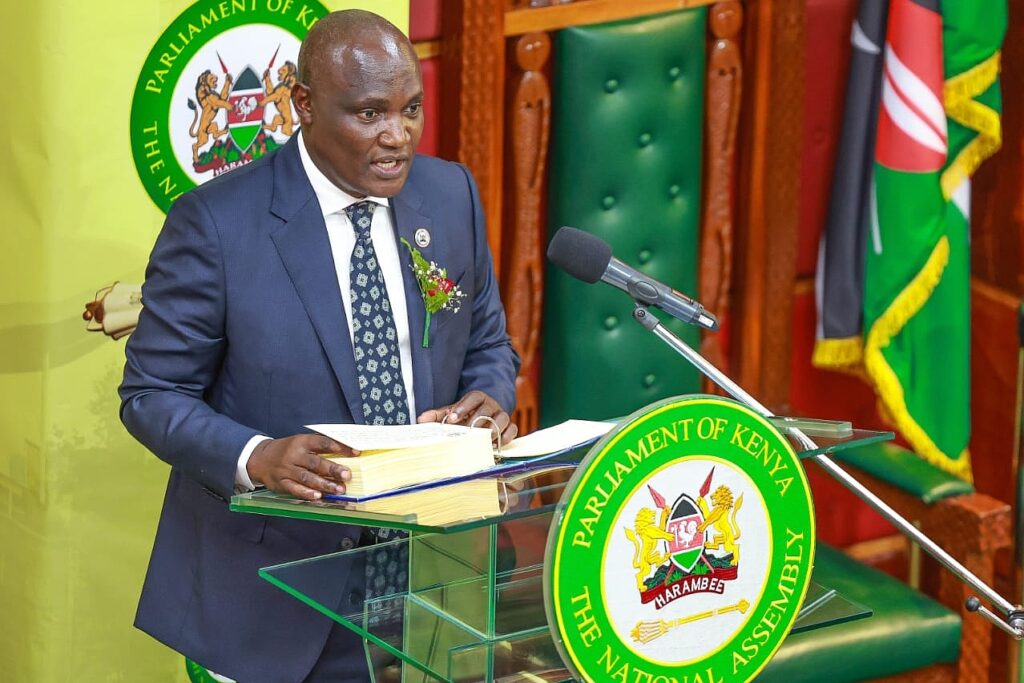

The reform push follows concerns raised by Cooperatives Cabinet Secretary Wycliffe Oparanya over the growing number of small, BOSA-only SACCOs that are either inactive or financially fragile. During the launch of the Sacco Supervision Report 2024, Oparanya noted that many such societies exist only on paper, while the few that are operational struggle to remain viable due to limited membership and weak capital bases. “The reality is that some SACCOs are not stable or sustainable. They serve too few members to survive in the current environment,” Oparanya said. To address this, the Ministry of Cooperatives plans to issue clear merger guidelines to ensure consolidation is orderly, transparent, and beneficial to members, particularly those in small or low-income societies.

Strengthening Governance and Oversight.

Beyond mergers, the reforms introduce new governance measures aimed at protecting members’ savings and improving oversight. SACCOs with more than 5,000 members will be required to adopt a delegate system, allowing for more efficient and representative general meetings. In addition, SACCOs will be restricted from borrowing externally to pay dividends unless they receive written approval from the Commissioner for Cooperatives — a move intended to curb risky financial practices that could undermine stability. The government is also reviewing the current SACCO registration threshold of 10 members, particularly for transport and smaller cooperatives, as part of efforts to improve sector regulation and sustainability.

A Turning Point for the Cooperative Movement

As Kenya’s cooperative sector evolves, the proposed mergers and governance reforms signal a shift toward stronger institutions capable of protecting members’ savings, adopting modern technology, and competing in a changing financial landscape. For cooperative leaders and members alike, the message from government is clear: size alone is not the goal — stability, integrity, and member value are.