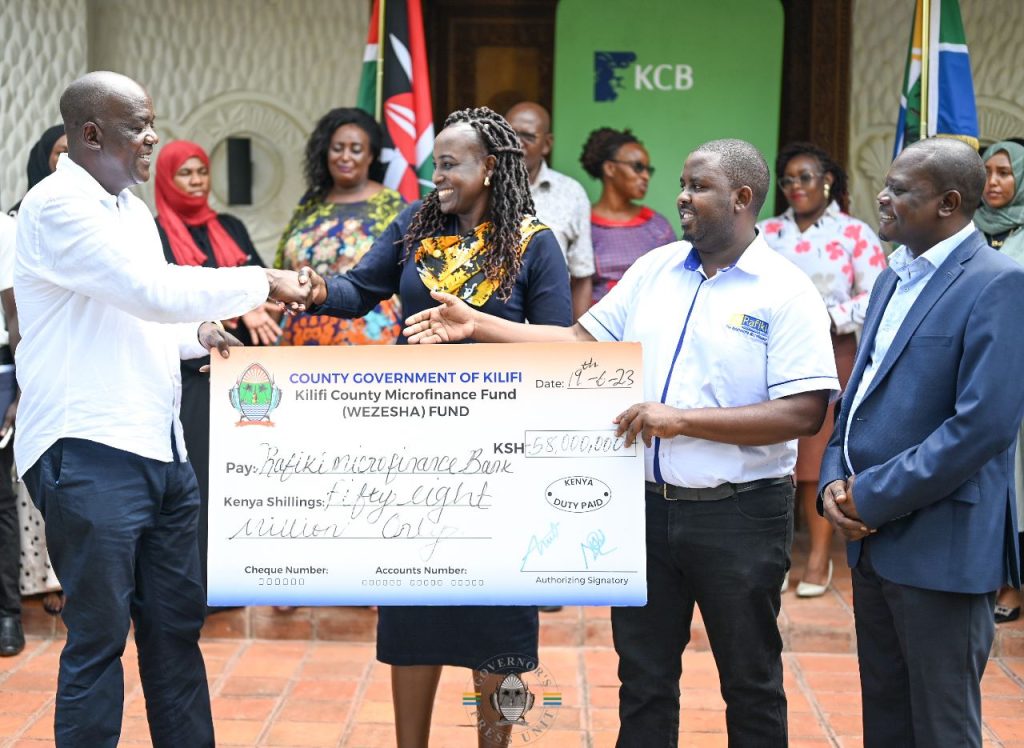

The county administration of Kilifi, in collaboration with KCB Bank and Rafiki micro finance Bank, have revived a business fund that will witness significant growth for small-scale merchants and enterprises in the cooperative economic model and stimulate economic growth in the entire county.

The fund, previously known as the Mbegu Fund in the county government’s 2016 microfinance bill, underwent a third modification to change its name to the Wezesha Fund.

“Wezesha Fund will now operate under a new structure that will ensure effectiveness and accountability to all beneficiaries, as well as facilitate loan recoveries and reimbursements,” Kilifi County Governor Hon. Gideon Maitha Mung’aro explained during the launching of the fund program, at the governor’s official residence.

He emphasized that people in the informal business sector, such as bodaboda riders and other business models, should form and register chamas and apply for the fund, as he promised that wezesha loans would be processed within one week, unlike its predecessor, the Mbegu Fund Program, which used to take up to a month.

Annastancia Kimtai, Managing Director of KCB Bank of Kenya, said it was a golden opportunity for the people of Kilifi to skyrocket their businesses because the bank is willing to provide the necessary financial training, mentorship, and financial referencing through the partnership and empower the society.

She congratulated the county governor for the collaboration, which she praised as a courageous step towards altering people’s lives through business and stated that she was, “looking forward to a long- lasting relationship with the community.”

She also promised non-financial assistance, like business networking and other services, through the bank’s biashara club.

Rafiki microfinance bank manager at the Mtwapa branch, Samuel Mburu Ngeshu, stated that the bank is focused on uplifting MSMEs by providing support for actual contract jobs, LPOs, LSOs, and the transformation of micro traders to MSEMs and, eventually cooperatives.

Share this story: